In an era where the real estate market poses numerous challenges, particularly in terms of affordability, innovative solutions like the 3-2-1 buydown are emerging as beacons of hope for both buyers and sellers. This article delves into the essence of a 3-2-1 buydown, a strategy that might be your key to navigating the current market conditions effectively.

What is a 3-2-1 Buydown?

A 3-2-1 buydown is a financial concession designed to make homeownership more accessible. Essentially, it’s a way to reduce the mortgage interest rate - and consequently, the monthly payments - for the first three years. This reduction is structured incrementally, offering significant initial savings and a gradual transition to the standard rate.

How the 3-2-1 Buydown Works

The mechanism of a 3-2-1 buydown is straightforward yet impactful. In the first year, your interest rate is reduced by 3 percentage points, followed by a 2-point reduction in the second year, and finally, a 1-point reduction in the third year. From the fourth year onward, the interest reverts to the original rate agreed upon in your mortgage.

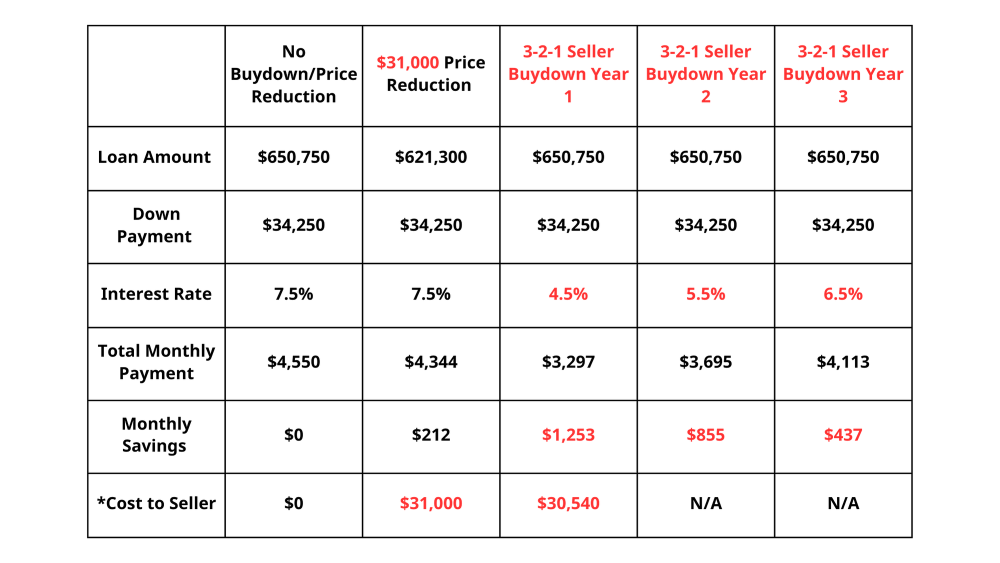

To understand the tangible benefits, consider this scenario:

3-2-1 Seller Buydown vs Price Reduction

Purchase Price $685,00 with 5% Down

*Total monthly payment does not include taxes, insurance, or private mortgage insurance (PMI). Numbers are rounded to the nearest dollar.

This reduction in the initial years can make a substantial difference in your budgeting and financial planning.

Advantages of the 3-2-1 Buydown

From a buyer’s perspective, the most obvious advantage is the reduced financial burden in the early years of homeownership, which can be particularly helpful for those adjusting to new financial responsibilities. For sellers, offering a 3-2-1 buydown can enhance the attractiveness of their property, appealing to a wider array of potential buyers.

Buyer’s Perspective:

For buyers, the immediate benefit is the lower monthly payments at the start. This arrangement can be especially beneficial in scenarios where buyers anticipate a gradual increase in their income or require time to adjust to homeownership costs

.

Seller’s Perspective:

For sellers, incorporating a 3-2-1 buydown into the sale can provide a competitive edge. It broadens the pool of interested buyers and demonstrates a commitment to assisting buyers in a challenging market.

Consulting with a Lender

Seeking advice from a lender can clarify the specifics of a 3-2-1 buydown and its suitability for your circumstances. Lenders can offer tailored advice and help you navigate the application process.

Potential Risks and Drawbacks

While the 3-2-1 buydown offers several benefits, it’s important to remain cognizant of potential risks, such as market volatility and the commitment to higher rates in the later years.

Navigating the Real Estate Market with a 3-2-1 Buydown

For buyers, a 3-2-1 buydown can be a strategic approach to entering the real estate market, especially in high-demand areas. On the other hand, sellers can use it to make their properties stand out.

How We Can Help

Our team is dedicated to connecting you with knowledgeable leaders and providing guidance throughout the buying or selling process. Whether you’re looking to buy, sell, or are just exploring your options, we’re here to assist.

The 3-2-1 buydown presents a promising opportunity for both buyers and sellers in today’s real estate market. If you’re looking to buy or sell, exploring this option could lead to a more manageable and financially savvy homeownership journey.

Next Steps:

- Email us at [email protected] to schedule a free consultation or to request a lender recommendation.

- Request a home valuation

- Download the KWApp and start searching

- Download one of our guides: Buyer’s Guide or Seller’s Guide

Still not sure where to start? No worries, give us a call or send us an email, and we’ll point you in the right direction.